One Mnet Health

The Patient Experience: What Has Changed?

Our parents and grandparents experienced healthcare in a straightforward way. They went to a doctor…

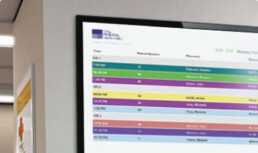

Reducing Staff Burden Through Technology

It’s been rough the last few years at Ambulatory Surgery Centers. Staff members have had to take on…

How Healthcare Consumerism Is Affecting Your Facility

Healthcare consumerism refers to the recent movement in the United States toward patients taking a…

Derek's Corner: Meet The CEO, Derek Smith

Derek Smith, CEO of Mnet Health, is a proven executive who is passionate about the ability of…

Revitalizing Your Surgical Facility’s Patient Intake Process

The patient intake process plays a significant role in the overall patient flow and directly…

Our Tips For Onboarding New Technology In Your ASC In 2022

Introducing new technology in your Ambulatory Surgery Center can be a complex process. Some staff…

Our 2021 Story and Outlook for 2022

As we step into a new year, we reflect on what has transpired over the last 12 months and express…

Women In Healthcare Series: Mary Gainey's Story

The third feature in our Women in Healthcare series goes to Mary Gainey, Call Center…

Best Outpatient Practices For 2022

An Ambulatory Surgery Center is only as successful as the satisfaction of its patients. Patients…

Setting ASC Goals For The New Year

It's the time of year when everyone is thinking about New Year's Resolutions and having goals for…

Mnet Health Fortifies Executive Leadership Team with a New Chief Revenue Officer, James Ryan

Mnet appoints experienced sales leader, James Ryan, to CRO. ALISO VIEJO, CA (PRWEB) DECEMBER 13,…

Six ASC-Friendly Ways To Spread Holiday Joy

In December, having a surgical procedure is particularly stressful because most people are trying…

Is Your Patient Experience Fitting for Stars?

In the surgical industry, patients are not only looking for positive clinical outcomes but also…

One Medical Passport and Mnet Health Announce the 2021 Winner of ‘Everyday Heroes Program’ to Honor the Unsung Heroes of Outpatient Surgery

The 2021 ASC Everyday Heroes Program has concluded and one surgical industry professional has been…

Women In Healthcare Series: Lauren Illescas' Story

The second feature in our Women in Healthcare series goes to Lauren Illescas, COO at…

Winner Of The 2021 ASC Everyday Heroes Program

Earlier this year, One Medical Passport announced the second round of the ASC Everyday Heroes…

Recovering From Adverse Events In Your ASC

Even the best Ambulatory Surgery Centers face moments of adversity. Some of these may be adverse…

7 Ways to Thank Your ASC Patients This Thanksgiving

The patients at your ASC are your most valuable asset. Without individuals turning to your…

How to Prepare Your ASC for the Deductible Boom

The end of the year is approaching, when many patients have fully paid their insurance deductibles.…

2021 ASC Everyday Hero Top 3 Finalists

In July 2021, One Medical Passport announced the second round of the ASC Everyday Heroes Program.…